CVW School of Finance: Types of Accounts

CVW School of Finance:

Institutions & Accounts

Most of us have heard of stocks and bonds and, perhaps, mutual funds, and have the general notion that we should own investments in some way. Obviously, in my practice this is a frequent starting point with new clients. However, I’ve noticed that many people have difficulty with something much more basic than specific investments, that being: what is the actual difference between all the places where money can be held and what do the different account types mean?

This post will attempt to lay the foundation for understanding finance by describing the most common accounts at banks and financial services companies, although the concepts carry on to other types of accounts. I will do this with the most basic ideas, and with the assumption that the money you put in does not ever decrease, which is helpful for understanding these concepts, but does not reflect reality, i.e., nothing is without at least some risk of loss, and many investments carry tremendous risk.

A Little Theory

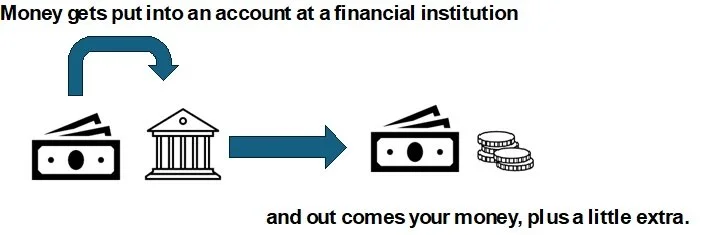

To begin, what underpins almost all financial transactions is the notion that money is nearly always being used for something and rarely just sits there doing nothing. So, any time you open an account where you want to hold or grow money, for whatever reason, your money will not just sit in place (there are a couple of exceptions which I will get to shortly). This is why institutions pay you for the privilege of holding your money. That is, they are going to use it to make more money by giving out loans or buying their own investments. And how do they pay you? Here are two examples: your savings account pays you interest, which is income for you and gets reported on your taxes; mutual fund companies will charge a fee but then pass on capital gains and dividends (more on these later) which are both taxable

This brings us to types of accounts. This is important because each institution and type of account has a different purpose and pays you in different ways. Let’s start with banks.

Helpful Diagram 1

Bank Accounts

Banks have four basic types of accounts: checking, savings, money market, and certificates of deposit (CDs). They do offer other products like IRAs, but those overlap with financial services and will be discussed below. (I’m also not entirely convinced that it’s wise to mix “safer” institutions with investment risk. Similarly, I’m not comfortable with apps that allow you to safely and quickly pay people while also letting you impulsively invest in crypto, but I digress)

Checking accounts are extremely “liquid”, meaning it is very easy to use what’s in there. You can write a check, use a bank card at a store, or get the money out of an ATM. Because of this liquidity, you are generally not paid any interest on what is in there, although some banks offer a very small rate.

Savings accounts are less liquid. You cannot buy groceries with a bank card attached to your savings nor can you write a check. Therefore, you can expect a little more interest, as it is assumed you’ve decided to let it stay put for a while. To entice you to keep it even longer, and to entice you to use their institution, many banks offer a high yield savings account (“yield” means “interest”). They are literally paying you more to leave your money with them, so that they can make more investments. Similarly, CDs generally pay the most because you are “locking” you money in for a defined period of time, which allows banks to know, with some certainty, how much money there is and for how long they can use it.

Money market accounts are similar to high yield savings, but because the money is actually invested in the money market, banks often charge fees or have higher minimums. This is because actual investments like this need to be settled before your money is available, even if the bank is willing to hand it back to you before they get the funds back.

Brokerages

Then there are places that specialize in investments, called brokerages. A few common examples are Fidelity, Schwab, and Vanguard, but there are many more. When you go to one of these businesses, you have to decide on the type of account you want, just like you have to do at a bank. Some offer checking accounts, but generally you are there because you want to grow your money more aggressively than what you expect from a bank. It is at these institutions that you take on more risk—in the hopes of a greater return-- by investing in stocks, bonds, ETFs, mutual funds, and so on.

Types of Accounts

The type of investment accounts available at brokerages are usually a brokerage account (aka Transfer on Death (TOD), Joint Tenant (JT), or another designation that reflects ownership or who inherits it), a traditional IRA, a Roth IRA, or another type of IRA. In general, all of these accounts can be used for the exact same types investments, be it Microsoft stock, an S&P 500 ETF, or digital assets like crypto (a future post will deal with the types of investments one might typically buy).

The difference between these accounts is in how they are taxed. In a regular brokerage account you are taxed any time an investment you own pays a dividend or interest. Interest would be for the same reason as a bank; you are being paid for letting a company use your money. A dividend is when a company, such as Microsoft, uses some of their profits to pay their owners, meaning those who own their stock. You are also taxed when your investment goes up in value (a capital gain) and you sell it for a profit.

A traditional IRA (short for Individual Retirement Arrangement) is a way for an individual to save for retirement. The government wants people to do this, so they allow you to put money into this account and subtract it from your income (called a deduction). When it comes time to retire, you can sell investments or use interest and dividends, take the money out of the account, and then you are taxed on what comes out.

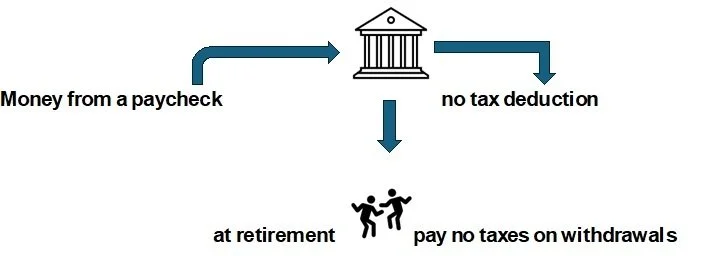

Helpful Diagram 2

A Roth IRA (named for William Roth, a Senator from Delaware, who introduced the legislation that created these types of accounts in the late 1990s) is another way to save for retirement. Here, the tax code allows you to put money in that you’ve already paid taxes on (meaning that you do not deduct if from you salary when you file your taxes at the end of the year) and when you take the money out in retirement you do not have to pay any taxes at all.

Helpful Diagram 3

Conclusion

In short, each institution has a different purpose and, in turn, has a menu of options for what to do with your money. A bank allows you to pay bills or hold money in a savings account so that it’s easy to access when it’s needed. A financial services company allows you to put your money more at risk, so that you can try to make even more money, and you can get favorable tax treatment if you are willing to wait for retirement by opening an IRA. Once these accounts are opened, you then get another menu of options for what type of work you want your money to do such as own part of a company (equities, AKA stocks), lend it out to companies (fixed income, AKA bonds), or however you decide to invest.

An important point is that there is overlap between what different financial institutions can offer. If you get an IRA through an insurance company or mutual fund company, it has the same tax rules as the IRA you open with a financial services company like Schwab. 401(k)s and other employer sponsored plans follow similar rules for tax treatment, as there are traditional and Roth versions of those. However, all of these various places may offer a different menu of options and impose other rules of their own.

I hope this helps to begin laying a basic foundation for understanding finance. Later posts will get into the details and complexities of each of the concepts discussed!

Disclaimer:

CVW Financial, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

The above discussion does not address evaluation of risk or loss at all as it is a discussion of types of institutions and accounts. Risk is an important part of financial decisions.